Despite the fact that fiat money plays a huge role in our society, we need to remind ourselves that it doesn’t have any intrinsic value. This underlying vulnerability is visible, and a predictable collapse of the present financial system is inevitable. Many economic experts have predicted that the modern financial system is on the edge of collapse.

Unless you have your head in the sand, you’ve probably realized that governments and central banks can print money out of thin air and in unlimited amounts. The United States and the Federal Reserve have been creating money from nothing for years because they had exhausted all their monetary policies. Despite the fact that many Americans will be happy to get a $1,200 check from the Treasury, the move will essentially debase the U.S. dollar, reduce it’s purchasing power, and make every citizen poorer.

From 2002 to 2018 US government debt increased from roughly $6 trillion to $22 trillion USD. The domestic product debt-to-gross government debt ratio also reached 100%. These factors increased the chance the US will let the value of the dollar decline so that it could pay back its debt with cheaper money.

When you think this was not scary enough, the US printed more money in one month than two centuries in 2020, ringing alarm bell to prompt the rich to act on their back up plan.

No Place to Hide in the Established Financial System

Nothing can hide the fact that the US is the biggest debtor country in the world, and is creating money in a careless and uncontrolled way. The goal of this is simple: The USA wants to maintain the illusion of wealth.

As a result, it is likely that the US dollar will go down in value in real terms until it becomes a global liability. The value of precious metals will increase, and gold will regain its monetary position at the heart of the world financial system.

But it is not just the US dollar, the entire world has gone the same tragic path of fiat-based currency. Every major economy uses fiat currency, and most will suffer when the USD-based system implodes.

Who else is being born to pay our debts?

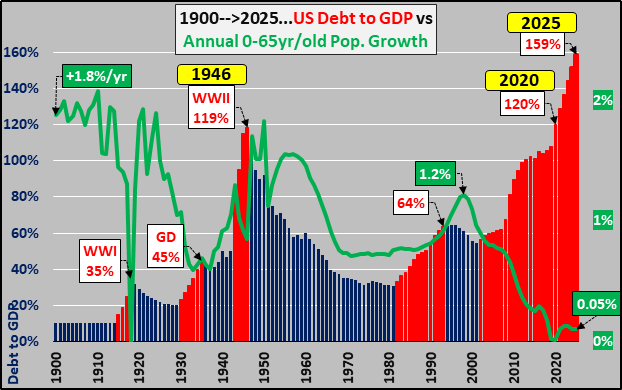

The chart below from IWB assumes 1.5% GDP growth through 2025 versus constant $2 trillion annual deficits after the 2020 $2.8 trillion blowout. While the under 65-year old population was projected to return to minimal growth, the pandemic is likely to turn that projected growth to decline and further decelerating potential economic activity.

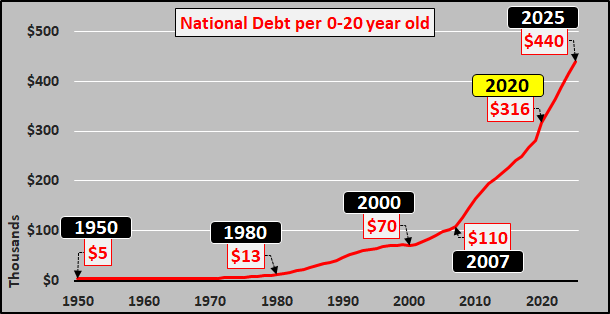

And just to put this debt in context, below is when adding relatively constant of under 20 year-old US population (the future that is responsible for servicing the debt) versus the rapidly growing federal debt.

Finally, putting the debt into personal terms against America’s future. While this population is not yet old enough to vote, they are sure to feel the full impact of the debt. Of course, over the course of their lives, they can never repay the debt nor can they even honestly service the interest payments. Instead they continue to see Federal Reserve policies rewarding the banks, large institutions, the asset holders, and the elderly. But this is only federal debt…if we added the soaring unfunded liabilities, you can likely quintuple those per-capital dollar amounts.

This debt is like an ever heavier weight spread across a population that isn’t growing…and eventually the policies of avoidance will crush whatever is under it.

Future Within Our Reach

The question now isn’t one of if modern money will collapse, it is a question of when.

A well-diversified portfolio with reduced dependence on the US dollar is one of the best ways to protect your finances right now. Once the system fails you have no alternatives left, and you need to have a plan in place right now.

But which assets should we keep?

Gold has served as a currency for over 4000 years, and the modern fiat dollar has only operated for about 50 years. Together with gold, silver may also be a good long-term strategy when the collapse of the current debt-based monetary order comes to pass.

More than Just Metals

While metals seem to lead the game, there is a new asset that makes a lot of sense: Bitcoin.

Cryptocurrencies are global assets that can be used without the permission of any third party and can be spent over the internet. While they are a new asset class, many professional investors are working to add them to their asset mix.

Over the next several years, several thousands of jobs and companies will be created worldwide, based directly and indirectly on Bitcoin technology. What really matters here is our understanding of the asset.

Whether you invest in physical gold or bitcoin, it’s crucial to prepare all the knowledge you will need. Most people still don’t understand how cryptos work, or how they could be used during a currency crisis to ensure that you have access to financial services.

You still have time to insulate yourself from the increasingly unstable global financial system and buy assets that can keep your finances safe during a crash. Take time to prepare today, while you are still in a position of strength.

If you would like to find out how prepared you are for this up coming The Great Reset, I’m offering a one off free money coaching session for new client for a limited time, because now it’s the time to take actions and I’m really passionate to help more people survive and thrive through this wave.

To your success!

Lowina Blackman

xxx