3 Reasons Why You Should Buy Physical Silver

Let’s ask a Simple Question: Is Physical Silver A Good Investment?

While the future of silver use remains a question, it’s undeniable that investing in this white metal is likely a safe long-term bet.

In addition to being used as an industrial metal, silver has a long history of use as money. At the moment it isn’t being used for monetary purposes, but if that demand reentered the market, the price could increase very quickly.

Here are three reasons why anyone should seriously consider buying physical silver as a long-term investment. While investment in physical metals isn’t the most common thing in the West, there are compelling reasons why it is a good idea going forward.

1. Silver as Insurance

Worries about inflation have risen. The central bank experiment that begin in 2008 is likely to create inflation. More investors are looking for ways to protect against potential damage from inflation.

Economic analysts can predict the next financial collapse, only after they see it and it’s too late to seek protection. Precious metals in general, particularly silver, are a compelling investment to hedge against unforeseen risks in the global marketplace.

A small investment in silver can serve as one month grocery shopping in case monetary upheaval hits, or the fiat money system collapses. We see how quickly a major virus can affect the global economy, and it there may be more problems lurking.

Silver investment is cheap compared to gold, and it is widely recognized as a valuable metal. The white metal is not only more accessible to buy, but also more practical and versatile to spend for every day small purchases.

2. Silver Demand is Growing

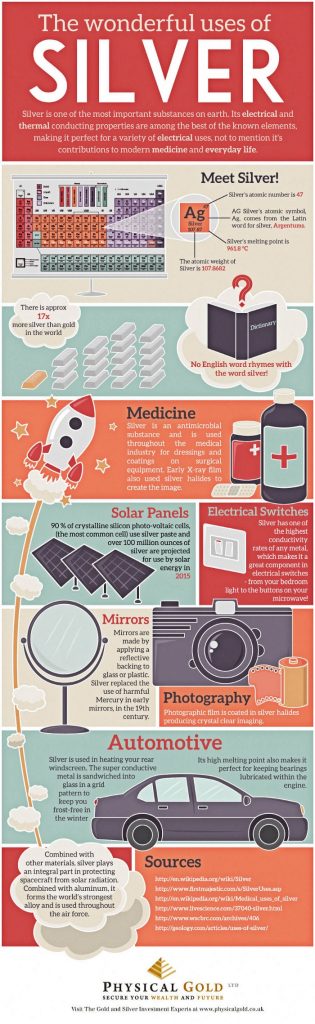

Silver has been around since the beginning of history. Silver is used in almost every major industry and you cannot go without using a silver-containing product in your daily life. We forget that while gold is recycled, silver is often left to rot in a landfill, and is removed from the economy.

The white metal is used in a variety of industries and goods and many of those uses are expanding. Apart from its role in the development of medicine and jewellery, it is also in demand in the industrial production of solar panels, smartphones, computers, microwaves and other consumer electronic goods.

Silver is even used in nuclear power stations. Each day, new ways of using this white metal are created. While global silver supply drops, its demand continues to grow, and this could lead to large silver deficits in the years ahead.

3. Silver Can Create Explosive Returns

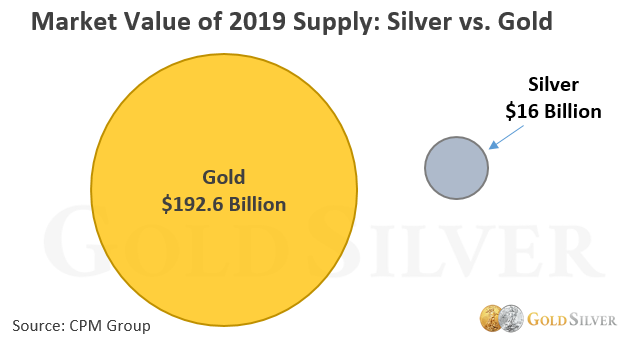

It is difficult to compete with gold’s reputation when it comes to potential returns. While it is true that gold has offered outstanding returns in the past and, silver has a history of explosive moves upward.

Since silver bullion is valued around 1/80th of the gold bullion price on an per-weight basis, it is inexpensive and promises to deliver a much higher percentage boost when silver prices grow. According to GoldSilver, silver has consistently outperformed gold in bull markets in the past.

GoldSilver reports that silver gained 448% from 2008 to 2011, while gold only gained 166% in the same period. Investors can hedge their bets in their portfolio with silver bullion and sell them back to industrial buyers when price shoots up.

You might not have thought about investing in physical silver, which is part of the reason why it is so cheap today. These kind of opportunities don’t last forever, and you might want to consider adding a little silver to your stockpile every month!

P.S: I have made a habit of buying small amount of silver coins from my local shop ABC Bullion in Melbourne, every time I visit the shop since 2019, there were always a queue of people buying physical gold and silver. Lately they ran out of stock a lot, we are actually lucky to be in Australia and still have stocks.

My friends in Hong Kong told me that they couldn’t get any investment grade silver bars anymore.

I wrote this blog back in 2019 when the price was still around USD $16/oz. Made a video in Jan 2020 before this global health crisis to tell my friends to buy some, as insurance to hedge against the weakening AUD. Trust this help you too.