As the virus spread, so does our economy slowdown too.

If you have been following the signs, you’re not surprised to see the next market expansion after 2008 has comes to the and about to pop any time soon, a recession is coming to reset the system. After the lesson you learned from 2008, this time around you come in prepared, you have been saving up, to set some cash aside, ready for the move.

In this article I’ll share with you how to jump from asset to asset based on their market cycles.

Not only you can protect your wealth, you can well position yourself in the receiving end of the wealth transformation opportunity.

How To Transfer Wealth?

Getting in and and out of markets:

- Start from market 1

- Buy low, Sell high, Take profit

- Move to market 2

- Buy low, Sell high, Take profit

- Repeat

How Central Banks Plans To Save The Economy

Step 1: Lower Interest Rates

Since the 2008 GFC the interest rate has been so low that if they keep lowering, it will become a negative interest rate.

It’s difficult to predict what will happen if we are going to negative interest rate, but I don’t think it is not great.

Step 2: Bail Out/QE (Money Printing)

The Fed is no ordinary bank: It creates ‘Monopoly money’ at the touch of a digital button and governments (or tax payers) then have to pay it back with interest.

QE means the central banks printing funny money lend to the government to buy assets, or to give away (stimulus package) or pay off debts, etc… using money out of thin air…

All of this extra money in circulation will devalue the dollar, and create inflation.

Money supply expansion creates a short-term boom, like in 2008.

But they can’t print money forever.. or else end up with hyperinflation like Zimbabwe.

Step 3: Bail In (Take Your Money)

Bail out is the government printing money to save the banks.

Bail in is the banks using your savings deposit money to save the banks.

This was tested in Cyprus in 2013. Governments now have a model to copy and Australia passed a new bail in law in 2019.

Why create bail in laws in the first place? Because they are going to use this tactic more in the future.

Let me unpack this more:

What is a Bail-In?

A bank bail-in is an attempt to resolve and restructure a bank as a going concern, by creating additional bank capital (recapitalisation) via forced conversion of the bank’s creditors’ claims (potentially bonds and deposits) into newly created share capital (common shares of the bank).

If your bank goes bust then your deposits/savings will be taken from you and turned into shares of the bank. You have no say in the matter because in legal terms, as a bank depositor, you are just an unsecured creditor of the bank.

ASSETS THAT I RATHER BE IN NOW

CASH

As Alex from Nuggest’s News says, “The US dollar is the cleanest shirt in the dirty laundry.”

During this uncertain time of planned restrictions, the feds are again printing more money, way more than the 2008 GFC.

Best to keep some US dollars and wait for the sales.

Before we dive into wealth creation or protection, always go back to the basics:

TAKE CARE OF YOUR EVERYDAY LIFE first.

Only when you have your 3-6 month emergency funds in place, then you can use any spare money to invest and grow real wealth.

CASH: Short term is good to hold; long term this fiat currency monetary policy game is coming to an end.

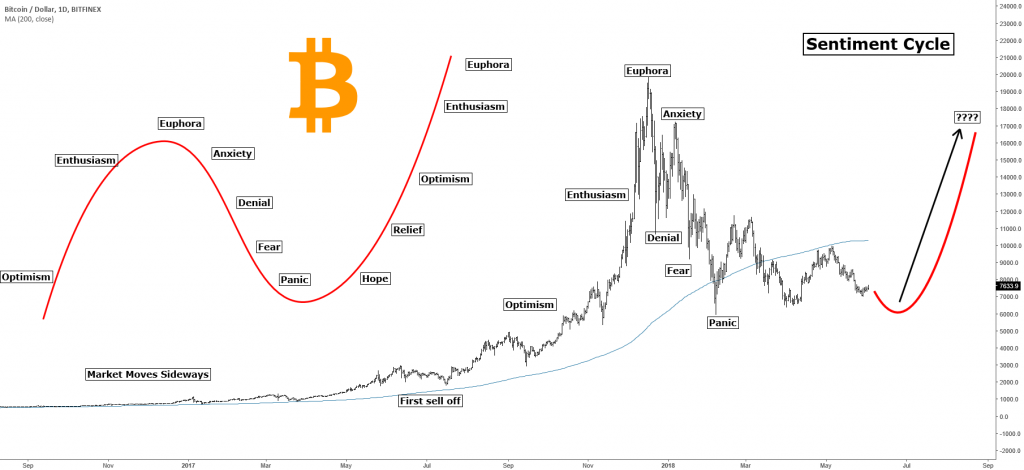

BITCOIN

You all know that I’m a long term bull, I will talk about Bitcoin all day long, which I won’t go into detail in this blog.

For now I would predict that 2020 will be a bumpy ride in choppy water in terms of the Bitcoin price.

Prices can still go lower because everything is crashing right now.

Some people are forced to sell their bitcoin to pay the rent; some weaker miners may forced to sell after the halving event in May 2020 and dip a little further; day traders may ‘cut their loses’ and sell their position…

Smart cash will now buy during this dip, shaking off the ‘weak hands’ and accumulate more Bitcoin before the next rally.

In the next 18 months to 2 years (after the Bitcoin halving in May), this cycle price is expected go up to 10-30x, up to the 6 figure range.

THEN WILL CRASH back to 5 figures, down 89% from the top, this is the nature of the Bitcoin cycle.

Make sure to harvest your profits and get out, ride the wave up and get out to buy cheap houses and value stocks.

GOLD

In my opinion Gold is undervalued and will boom once the USD collapses and we go into hyper inflation.

2-10x in the next 2-3 years if this play out as the precious metals investors’s prediction, like Peter Schiff or Mike Maloney.

Jim Rickards even say Gold could reach $50,000/oz.

Now is a good time for dollar-cost-averaging with your spare money and get a little bit of gold while you can, if you can even get them.

Personally, I treat gold as insurance, I won’t buy too much but it’s essential to keep some physical bullion in multiple safe places.

NOT paper gold, I’m talking about physical metal here, you must be able to hold it in your hands.

SILVER

Massively undervalued right now – huge industrial use for silver.

Price is expected to go up to 10-40x in the next few years.

Now it’s around $12-18/oz range up and down, Jeff Berwick from Dollar Vigilante even talking about $100/oz, $250/oz… he’s ready.

Gold will rally first, next is silver – the poor man’s gold.

Mike Maloney has TONS of silver stored in high secured places.

Again, get physical silver bars or coins, not silver stocks. There’s a shortage of physical silver now, waiting list is long.

Gold and silver serve different functions and have different market cycles, I can further unpack this if you want to know more.

ASSETS TO AVOID

Stock Market

Crashing but still over-valued, in my opinion it will come down more before it recovers, painfully and slowly, over the next decade.

The market has mysteriously gone parabolic (due to free funny money flooding in maybe?) It can’t go up forever.

You may want to harvest your profits now if possible, minimise your exposure, perhaps take your capital back so you can chill.

We don’t know how the market will crash, it could be in waves, or bear traps and bull traps, golden cross and death cross… depending on many things, we can look at candles charts all day but overall now it’s in a downward trend. Personally, even once it’s bottomed out, I won’t put too much funds into it.

Maybe next year or two, once the crisis is over, I would dollar cost averaging in and buy my way up.

Stock market tends tend to take much longer time to stay in the bear winter and recover, during this time I could be missing out on other opportunities.

My fund was stuck in the market in 2006, I ended up sold at a loss and bought an apartment instead.

I have learned my lesson about the market cycle, I got in the wrong time and got hurt.

In other words, I won’t go anywhere near it right now, I only have a tiny portion in the stock market.

Wait for the dip when my favourite value stocks get to half price or even 90% off and then go shopping.

Real Estate

I always like property because it can give you solid rental income, plus house price will go up long term.

I grew up with the mentality of “You must own three to four mortgage free properties and retired as a land lady”. Both my grand-mother and dad have 3+ apartments each, so I had 3 properties at one point.

However, I feel like house prices in Australia and Hong Kong are so hot now, seems like a never ending rise in price to the point that no young people can afford an apartment in the city.

With this crisis, Harry Dent predicts that real estate will get smashed, hard, back to 2000 prices he says.

I am so glad that I have I sold my investment property on Xmas eve 2019, didn’t make much profit (I made a video explaining how I got it wrong).

I just wanted to get out before the crash and get some cash to wait for shopping time.

Lucky that this extra cash saved me from this stay-at-home lock-down period.

My personal plan is when Bitcoin peaks over the next year or two, I’ll buy a cheap house.

** DISCLAIMER: I’m not your financial advisor. This is not financial advice. Do your own due diligence. **

Watch the video for full detail.

If you want to know more about how money mindset coaching works, chat to me lowinab@gmail.com

Stay financially healthy!