Earlier in 2020, lots of things happened in the world, The C word virus, Iran America war, protesting in Hong Kong and more, rich people are preparing to protect their wealth, the price of Gold and Bitcoin were rise up together, as I have previously mention how people like to compare the two base on their similarity.

In this video, we’ll take a closer look at Gold and Bitcoin in terms of which one is better to be used as money for things when people keep losing trust to their banks and monetary system.

In times when the dollar has collapsed or collapsing, the Feds, central banks and individual countries will start making their own digital currency to confused people that their with cryptocurrency is Bitcoin, but it’s not the same.

Shifting paper dollar to digital currency is just a new package, pouring old wine into new bottles. If the system behind these new digital currency is the same: printing more / increase or decrease rates / manipulating the values by one central point, people are still not going to trust it because this system is still designed to lose purchasing power.

People will want to park their wealth into something more promising and trusted.

Will Bitcoin or gold and can be use as cash/payment in the next two years? If so, how are they doing as money?

1. PORTABLITY

Traditionally, in the old days, you could carry a few small gold coins to the local market and you can pretty much buy anything on the spot, because Gold held a lot of value in a small place.

However, in the modern digital age where we shop online globally, it is not easy to, for example, use gold to buy toilet paper on eBay. Gold becomes less convenient in this digital economy and globalization.

There is a solution for this; you can use a third party company to transfer your gold ownership to someone else. For example, BullionVault.com or GoldMoney.com and many others can provide you with this service.

But I don’t like the idea of giving my gold to a second/third party and pay a fee whenever I shop, it introduces a third party risk where you are dependant on these companies and have to trust them to not steal your gold.

Portability is where Bitcoin shines. Bitcoin can be transferred anywhere in the world at anytime. As long as you have a phone or a computer with an internet connection, you can make payments almost instantly and at a low cost. Without going through a third party like PayPal, Visa, Western Union, Apple pay or WePay.

2. DIVISIBILITY

Gold can be divided into smaller amounts/ounces, but there are many limitations. As in the old days, you would need the equipment and set-up physically heat and melt the gold yourself, or pay someone to melt it for you, which takes extra steps to create the exact dollar amount of gold if you want to use it for spending later.

The other limitation is that 1g of gold is roughly US$50, but if you want to buy a coffee with gold, it would be impractical to pay with a 10mg of gold, because most businesses won’t except it.

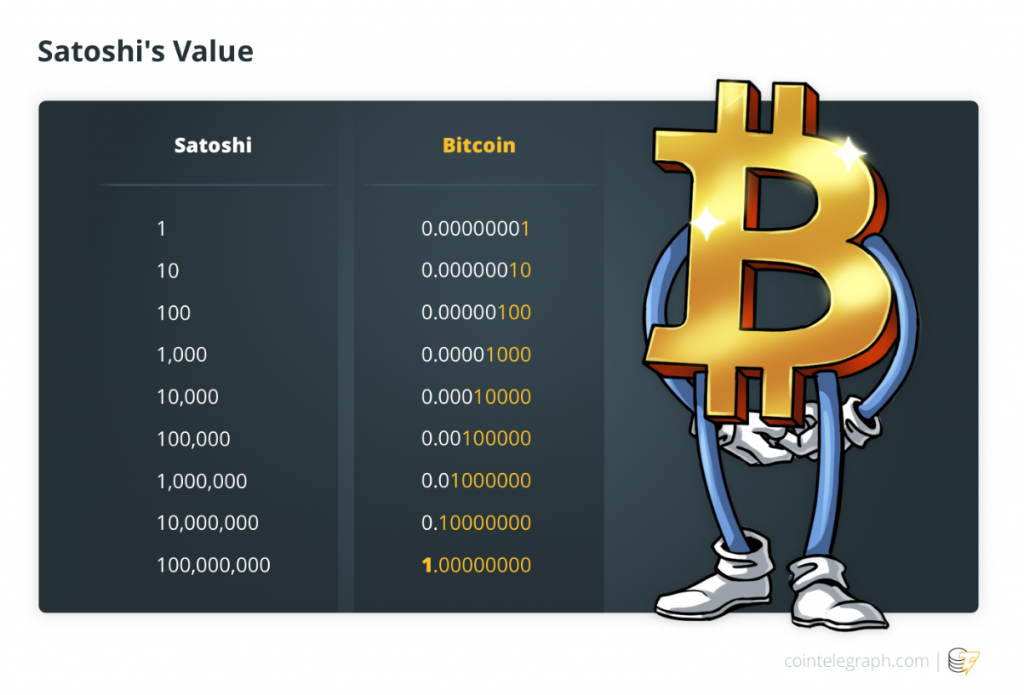

Bitcoin on the other hand is free to divide up to 1/100,000,000th (one/one hundred million) that we call a Satoshi. One bitcoin contains 100 million Satoshis.

You can send someone one satoshi as easy as sending someone one bitcoin which, could be worth a million dollars, almost instantly.

3. ACCEPTABILITY

Gold is not as convenient as a payment in the modern world. Because your everyday plumbers, doctors, supermarket cashier, photographers or cafés probably won’t except gold as payment for many legitimate reasons.

We may see the use of Gold as payment when people start losing trust with fiat currency due to economy crisis, but it would only be short term until another form of digital payment can solve the problem.

We changed Gold to paper money/fiat currency to pay for everyday goods and services for a good reason.

Bitcoin is not so great for acceptability in 2020 either.

Due to it’s volatility in price, difficulty to buy and store (for now) and not widely accepted in society/business. I don’t think my electrician would accept bitcoin as payment.

But Bitcoin is growing more popular everyday, more and more companies are developing faster and more improved platforms to make Bitcoin more user friendly as a method of payment for goods and services. More and more retails are slowly accepting Bitcoin as payment. My wedding photography company also accept Bitcoin and we have brides paying for their wedding packages with Bitcoin.

I believe in time the Bitcoin price will become more stable, young people will grow up being educated about blockchain technology, so there is huge potential for Bitcoin to be accepted as payment in the coming years.

4. SAFETY AND RESISTANCE TO REGULATION

Owning a large amount of Gold is not safe. If you store them in your house then one home invasion and you’ve lost everything.

If it’s not a robber in your home, the government can also take your gold, it has been done before when governments are in financial trouble.

Even the mighty US, made owning gold a criminal act.

In 1933 the US president signed an order to forbid the hoarding of gold coins, gold bullion and gold certificates, which made gold ownership illegal for all Americans and punishable by up to ten years in prison. Anyone caught with gold would also have to pay a fine of twice the amount of the gold that was not turned over to the Federal Reserve in exchange for paper money.

This ban was not lifted until 1974. This could happen in any country.

Because gold has no deniability and is in a physical location, governments can use their monopoly on violence to destroy its ability to be used as money/payment.

If you store gold at home, anyone with a gun can come in and take it from you.Bitcoin is remarkably robust and resilient to this kind of an attack because it exists on a decentralized peer-to-peer blockchain network, your Bitcoin can be stored in your head.

As long as you remember the private keys or your hardware wallet seed phrase, the man with a gun cannot take it from you. They cannot shut down the ‘server” or assassinate the CEO of the Bitcoin company. Because Bitcoin has no leader to remove or manipulate and no central point to ‘reboot’ the system, no one can actually stop or ban Bitcoin. They can try make it illegal to use it in their home country, but you can just move to Bitcoin friendly countries like Singapore, Japan, Hong Kong, Switzerland, Georgia and more.

Bitcoin is also completely counterfeit resistant. The Bitcoin algorithm and blockchain network is as strong as it’s ever been and keeps growing stronger as more and more miners come into the game. It would cost too much and take too long to hack the Bitcoin network that it is almost pointless, it’s cheaper to buy it or mine it, and you might as well do so legally.

Without the correct keys, it is virtually impossible to counterfeit Bitcoin.

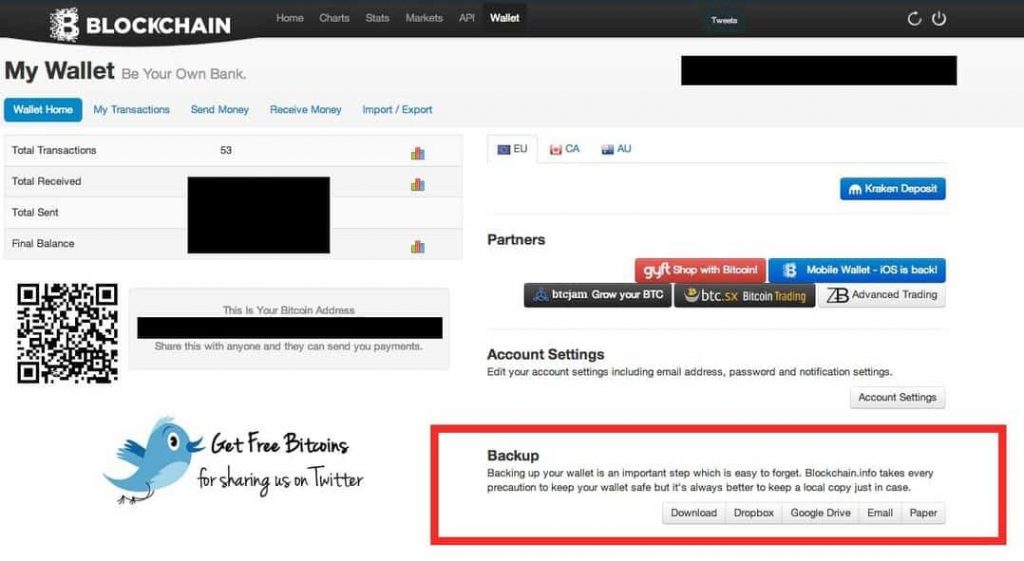

However, if you lose your private key or the seeds of your wallet, then the coins become lost forever. Without the private key, there is no one else can access your lost Bitcoin and claim it for themselves.

It is super important that you backup your wallet as a first priority. I would say Bitcoin is the safest and secured way to store value other than gold.

5. DURABILITY

Gold has strong durability. It is fire proof, surviving high heat from a normal house fire, gold can survive up to 1,000 °C.

It is rust proof and can lie at the bottom of the ocean for a thousand years without losing its value.

Bitcoin can be backed up and stored in multiple locations all around the world, therefore can exist in every country in the world to avoid fire and flood damage as well.

6. BASELINE VALUE

Gold has historically been used in many applications, from luxury items like jewellery to specialized applications in dentistry, electronics, and more.

Gold will never go to a value of zero and become worthless due to its 5,000 year history, there is a long history of trust in gold.

Gold is rare and has a finite supply, it would cost a lot of money, labour and time to mine gold from the earth. But there is more gold that is buried in the ocean and in asteroids in space which, we haven’t developed the technology to mine yet.

NASA is eyeing up a nearby asteroid that contains enough gold to make everyone on Earth a billionaire and is reportedly sending droids to check it out.

Bitcoin on the other hand has a much more specific fixed amount of supply: 21 millions.

The last piece of bitcoin will be mined around 2140. Satoshi designed Bitcoin supply to cut in half every 4 years or so, which is called The Bitcoin Halving.

I have made a video to talk about this coming cycle, which will occur in a week, in May 2020.

As former Facebook executive and self made Bitcoin Billionaire, Chamath Palihapitiya, says.. “Bitcoin will either go to zero or millions in value, because it either works or it doesn’t”.

For now, the risk to reward ratio is so high with Bitcoin. If you have invested $100 in Bitcoin 5 years ago, you would have $3,600 by now, I’ll take that risk.

7. TANGIBILITY

If you dig a hole somewhere on a mountain to put your gold in and forget to draw a treasure map and then you die or forget where you put it, your gold is probably lost forever until a very lucky guy with metal detector finds it and claims as it theirs.

Bitcoin is similar in this sense. As mentioned, if you forget your private key and have not backed up, then your Bitcoin is also lost forever.

However, the advantage for Bitcoin is that you can back it up in a thousand different locations if you want to and teleport it all back to yourself anytime you wish, so long as you have an computer and internet connection.

Bitcoin can be stored in multiple locations at once but can only be spent once. Like a redeemable coupon code, you can email a thousand copies everywhere but you can only redeem it once.

Since Bitcoin is its own peer-to-peer global payment system, there is no third party risk. You can send a million dollars across the globe and store it there for 10 years, without involving a single other human in the transaction, and no storage fees.

Just to be prepared, I have both. ☺

Besides overall volatility, bitcoin is a rather simple long-term payment model.

Perhaps the biggest question it hinges on is exactly how much adoption will Bitcoin have in the coming years?